| 1. | The mortality protection gap (MPG) is defined as protection needs of the remaining family members (i.e. the money required to maintain the living standard of the remaining family members) upon the premature death of the breadwinner minus the resources available. |

| 2. | To facilitate a rapid assessment, as you answer simple questions about your current income and family status, you can obtain a report on your current MPG in 5 minutes. If you face a MPG, you may consider filling your protection gap with life insurance. |

| 1. | Your MPG will change over time when you make important decisions, and as your financial resources accumulate. |

| 2. | Apart from life insurance, you may have other insurance needs, depending on your lifestyle and preferences. |

| 3. | In 10 minutes, by answering some questions about your future life planning and lifestyle, you can obtain your projected MPG for coming decades, see when you will face the largest MPG, and obtain useful information about your needs of non-life insurance products. |

Because of the approach and assumptions adopted, this assessment tool is designed for working persons aged between 18 and 65, and the calculation of MPG works best for breadwinners who pay most of the expenses for their families, whose income and expense levels are closer to Hong Kong’s average, and for those who finance their family spending within their means (i.e. employment income).

For families with more than one working person, the breadwinner who pays most of the expenses should take the MPG assessment, as this should better reflect the actual protection needs of the family.

If you believe that your situation (such as expenditure pattern and share of responsibility with your family) deviates largely from the others, it is encouraged that you also try out other calculators based on expenditure, and/or consult your professional financial advisors.

To facilitate general use, the Insurance Authority adopted an income approach for assessment. Compared with other assessment methods, such as estimating current and future expenditure, the income approach can minimise your input efforts. You only need to input information of current income, family status, and future life planning, and need not estimate and forecast the inconceivable future expense items one by one. As such, the simplicity of income approach helps concluding your MPG quickly.

Employment income is key in our model as the protection needs including household expenses (both present and future), medical expenses and education expenses are thus estimated according to the in-built calculating model with reference to data from government’s General Household Survey and Household Expenditure Survey.

It is an important note that you may find the questions asked and the results from this assessment tool different from other similar tools or calculators in the market. It should be mostly explained by the adoption of different assumptions. For example, the MPG results generated by calculators and tools using expense approach would be largely determined by your own estimates and forecast of various future expenses.

Macro assumptions: this tool makes assumptions about annual income growth (3.1%), annual investment returns (6.1%), and interest rate (1.9%). As these assumptions can significantly affect the size of the estimated MPG, if you have different expectations, you can change these assumptions in the full version.

Limitations:

Our in-built income approach helps concluding MPG with simplicity. However, the following conditions could drive significant deviation of calculated MPG from real life:

-

Personalised spending pattern: a large part of future household expense is estimated using AVERAGE ratios of expense to income of typical families in Hong Kong, same as the framework of the Mortality Protection Gap study. Therefore, the assessment results will be more accurate for individuals whose situation is closer to the average situation of the society.

- For those with spending pattern apparently different from average value of typical families in Hong Kong, results may deviate more from other calculators relying on users’ expenditure forecast. For example, you are spending beyond your income, or spending little on your family compared to your income. The latter case may be more prominent for high-income earners.

- Share of responsibility in a household: This tool assumes that each working individual contributes a percentage of their income towards household expenses. In reality, if there is more than one working individual in a household, the actual share of financial responsibility is likely to be different from that assumed in this tool. For example, if you are in a two-person family with both of you working, if your spouse has high income and pays most of household expenses, your MPG may be notably overestimated and vice versa.

- Financial burden from other households: The estimation of general household expenses is confined to the household in which you are living at. Dependents not living together (e.g. parents) are assumed to depend on you for medical costs only. Therefore, corresponding protection needs may be underestimated.

- Projection beyond retirement age: The income approach targets working class. The projected MPG beyond retirement age, when you have no employment income, can be seriously over- or under-estimated. Conceptually, your attention is invited to the changing MPG before retirement age, as retirement planning may be more important beyond retirement.

-

Full version

evaluate your current and future protection needs

(10 minutes) -

Simplified version

evaluate your current protection needs

(5 minutes)

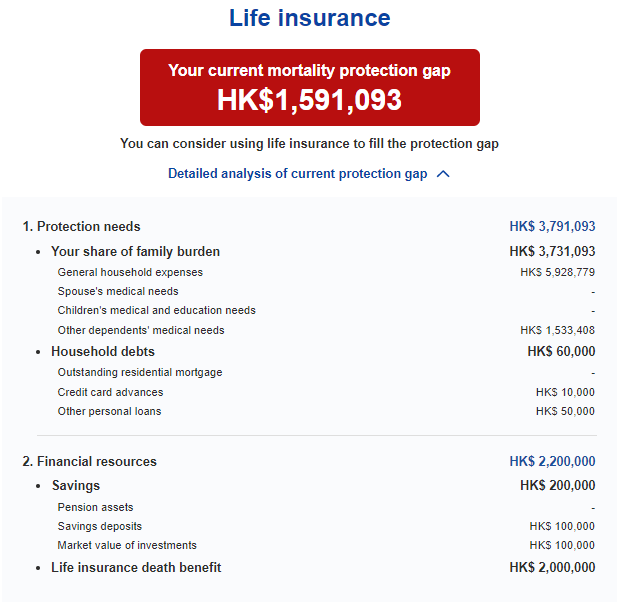

You can consider using life insurance to fill the protection gap

Your current financial resources are temporarily sufficient to cover your protection needs

-

Protection needs-

-

Your share of family burden-

-

General household expenses-

-

Spouse's medical needs-

-

Children's medical and education needs-

-

Other dependents' medical needs-

-

-

Household debts-

-

Outstanding residential mortgage-

-

Credit card advances-

-

Other personal loans-

-

-

-

Financial resources-

-

Savings-

-

Pension assets-

-

Savings deposits-

-

Market value of investments-

-

-

Life insurance death benefit-

-

- Life insurance

- Accident and Medical Insurance

- Critical illness insurance

- Retirement Protection

- Property and liability insurance

You can consider using life insurance to fill the protection gap

Your current financial resources are temporarily sufficient to cover your protection needs

-

Protection needs

-

Your share of family burden-

-

General household expenses-

-

Spouse's medical needs-

-

Children's medical and education needs-

-

Other dependents' medical needs-

-

-

Household debts-

-

Outstanding residential mortgage-

-

Credit card advances-

-

Other personal loans-

-

-

-

Financial resources

-

Savings-

-

Pension assets-

-

Savings deposits-

-

Market value of investments-

-

-

Life insurance death benefit-

-

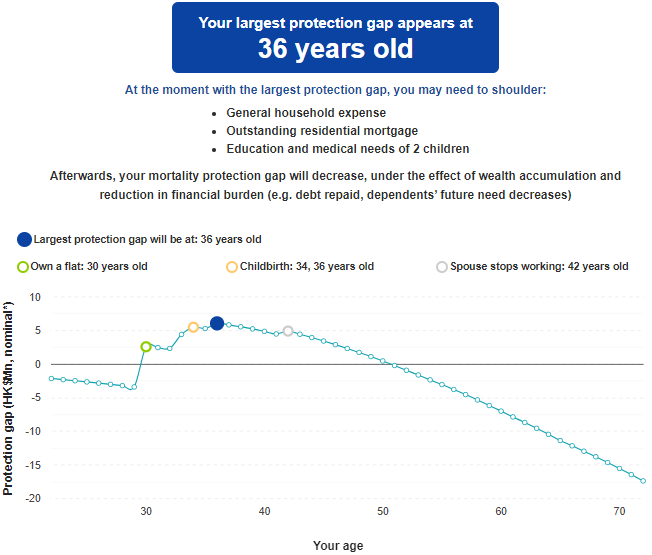

- General household expense

- Outstanding residential mortgage

- Spouse's medical needs

- Education and medical needs of children

- Medical needs of other dependent(s)

Afterwards, your mortality protection gap will decrease, under the effect of wealth accumulation and reduction in financial burden (e.g. debt repaid, dependents’ future need decreases)

* Figures in nominal terms are calculated at the then-prevailing market prices. i.e. not net of the effect of inflation. For instance, assuming that you are now 25 years old, the protection gap at age 35 is calculated at the price level 10 years later, which usually is not equivalent to current price level.

As shown by the chart above, your mortality protection gap will change over time, and will be affected by your timing of making life decisions. Therefore, as a smart policyholder, you should review and adjust your insurance portfolio regularly in order to achieve comprehensive and sufficient risk protection.

When choosing life insurance products, you should assess whether each insurance product suits your needs at different life stages, and choose the most suitable one based on your affordability and needs. You should pay attention to the relationship between premium, sum assured and age of policyholder.

The relationship between life stages and shape of the above curve are demonstrated by case studies in the Mortality Protection Gap Study 2021, carried out by the Insurance Authority. For details, refer to Chapter VI of the Study.

Consider whether you can afford the relatively long waiting time for public medical services. Although the public healthcare system in Hong Kong offers relatively affordable medical services, they are always over-utilised. This often means long waiting times for non-urgent medical treatment. You may be unable to receive instant medical care.

If you prefer private medical service, consider taking out accident insurance or a medical insurance policy. Insurance is a risk transfer tool that allows insured persons to shift responsibility for some of their medical expenses to an insurer.

Learn more about the price level of private medical services by making reference to the published price lists on the websites of private hospitals. If you find the charges unaffordable, consider taking out accident and medical insurance that suits your needs, to shift the responsibility for some of your medical expenses to an insurer.

Bear in mind that group medical insurance works on a reimbursement basis to cover the actual medical expenses. Pay attention to the adequacy of your existing protection in terms of coverage, policy limit and benefit limits. If you don’t find that it is suitable for your needs, consider taking out additional individual medical insurance that suits your needs to fill the protection gap.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Evaluate the adequacy of the protection of your existing policies, in terms of coverage, policy limit, sub-limit for each benefit item, and deductible. If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Accident insurance typically pays a lump-sum benefit for accidental death or disability. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Make sure you understand the functions and coverage of accident insurance. It typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide inpatient or outpatient coverage for medical treatment arising from an accident. However, bear in mind that accident insurance covers only conditions that result from unexpected accidents. If you wish to be covered for other non-accidental conditions, such as illness, consider taking out individual medical insurance or the Voluntary Health Insurance Scheme (VHIS).

Make sure you understand the functions and coverage of critical illness insurance. It provides a lump-sum benefit if you are diagnosed with a specified critical illness covered by the policy. The use of the benefits is not restricted. You can use them for loan repayment or the daily expenses of your dependents, for example.

Medical insurance, however, works on a reimbursement basis to cover actual medical expenses. It does not require the condition of specified critical illness. Therefore, if you are covered only by critical illness insurance, consider whether you need medical insurance, which provides protection fitting your needs.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Learn more about medical insurance and accident insurance and choose the appropriate products to shift some of the potential medical expenses to your insurer.

Medical insurance works on a reimbursement basis to cover actual medical expenses, subject to a cap. Common types of coverage include hospitalisation and outpatient protection. Some medical insurance policies may also provide hospital cash benefits for the insured person.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident.

Evaluate your needs for healthcare protection and choose the insurance product(s) that best suits your needs.

Review your current protection and consider whether your medical needs are well addressed, in terms of coverage, benefit limits and deductibles even if you already have two types of protection: group and individual medical insurance or the Voluntary Health Insurance Scheme (VHIS).

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Review your current protection and consider whether your medical needs are well addressed, in terms of coverage, benefit limits and deductibles even if you already have two types of protection: group medical insurance and personal accident insurance.

Bear in mind that group medical insurance works on a reimbursement basis to cover actual medical expenses and learn more about the protection details, such as coverage, policy limit and sub-limit for each benefit item. If you don’t find that it is suitable for your needs, consider taking out an additional individual medical insurance policy that suits your needs to fill the protection gap.

Be aware of the difference between group medical insurance and critical illness insurance.

In general, group medical insurance works on a reimbursement basis to cover the actual medical expenses. Learn about the protection details, such as coverage, policy limit and sub-limit for each benefit item. If that do not match with your needs, consider taking out an additional individual medical insurance policy that suits your needs to fill the protection gap.

Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by the policy. There are no restrictions on how you can use the benefits. You can use them to repay a loan or for the daily expenses of your dependents, for example.

Accident insurance typically pays a lump-sum benefit for accidental death or disability. Some accident insurance plans provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Review your current protection and consider whether your medical needs are well addressed, in terms of coverage, benefit limits and deductibles even if you already have two types of protection: individual medical insurance or the Voluntary Health Insurance Scheme, and personal accident insurance. Think about how to make a good use of both types of coverage if you are ill or injured.

If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Review your existing policies and make sure you understand the difference between individual medical insurance or the Voluntary Health Insurance Scheme (VHIS), and critical illness insurance, so that you are covered by suitable insurance.

Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by your policy. There are no restrictions on how you use the benefits. You can use them to repay a loan or for the daily expenses of your dependents, for example.

Individual medical insurance or the VHIS, in general, works on a reimbursement basis to cover actual medical expenses, subject to a cap. Review your existing protection in terms of coverage, policy limit, sub-limit for each benefit item and deductible. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Review your existing policies, and make sure you understand the difference between critical illness insurance and personal accident insurance, so that you are covered by suitable insurance.

Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by the policy. There is no restriction on how you use the benefits. You can use them for loan repayment or for the daily expenses of your dependents, for example.

Medical insurance works on a reimbursement basis to cover actual medical expenses. There are no specified types of critical illness. Therefore, if you are covered only by critical illness insurance, consider whether you need medical insurance, which provides protection fitting your needs.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. However, bear in mind that accident insurance covers only conditions that result from unexpected accidents. If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Review your current protection, and consider whether your medical needs are well addressed, in terms of coverage, benefit limits and deductibles, and make sure you understand the functions of each of your insurance policies: group medical insurance, individual medical insurance or the Voluntary Health Insurance Scheme, and personal accident insurance.

Medical insurance works on a reimbursement basis to cover actual medical expenses. There are no specified types of critical illnesses. Therefore, if you are covered only by critical illness insurance, consider whether you need medical insurance, which provides you with more targeted protection.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. But bear in mind that accident insurance covers only conditions that result from unexpected accidents. If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Review your existing policies and make sure you understand the difference between group medical insurance, personal accident insurance and critical illness insurance, so that you are covered by suitable insurance.

In general, group medical insurance works on a reimbursement basis to cover actual medical expenses, subject to a cap. Evaluate whether your coverage is sufficient in terms of coverage, policy limit and sub-limit for each benefit item.

Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by the policy. There is no restriction on how you use the benefit. You can use it to repay a loan or for the daily expenses of your dependents, for example.

Accident insurance typically pays a lump-sum benefit for accidental death or disability. Some accident insurance plans also provide inpatient or outpatient coverage for medical treatment arising from an accident.

If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Review your current protection, and consider whether your medical needs are well addressed, in terms of coverage, benefit limits and deductibles, and make sure you understand the functions of each of your insurance policies: individual medical insurance or the Voluntary Health Insurance Scheme (VHIS), personal accident insurance, and critical illness insurance.

Individual medical insurance or the VHIS, in general, works on a reimbursement basis to cover actual medical expenses, subject to a cap. Evaluate whether your existing protection is adequate.

Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by the policy. There is no restriction on how you use the benefit. You can use it for loan repayment or for the daily expenses of your dependents, for example.

Bear in mind that accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident.

If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Review your existing policies, and make sure you understand the difference between group medical insurance, individual medical insurance or the Voluntary Health Insurance Scheme (VHIS), and critical illness insurance, so that you are covered by suitable insurance.

Group medical insurance, individual medical insurance or the VHIS, in general, works on a reimbursement basis to cover actual medical expenses, subject to a cap. Determine whether your existing protection is adequate in terms of coverage, benefit limits and deductibles.

Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by the policy. There are no restrictions on how you use the benefit. You can use it for loan repayment or for the daily expenses of your dependents, for example.

Accident insurance typically pays a lump-sum benefit for accidental death or disablement. Some accident insurance plans also provide hospitalisation or outpatient coverage for medical treatment arising from an accident. Consider taking out an accident insurance policy if you do not have this coverage at the moment.

Review your current protection and consider whether your medical needs are well addressed, in terms of coverage, benefit limits and deductibles, and make sure you understand the functions of each of your insurance policies.

Critical illness insurance is different from medical insurance and accident insurance. Critical illness insurance provides a lump-sum benefit if you are diagnosed with a critical illness covered by the policy. There are no restrictions on how you use the benefit. You can use it for loan repayment or for the living expenses of your dependents, for example.

If you are not sure about your protection, consult your insurer or intermediary. If you find your current protection is insufficient, consider adjusting your insurance portfolio.

Consider whether you can afford the future living expenses of you and your dependents, if you lose your ability to work in the event of a serious illness. Critical illness insurance provides a lump-sum benefit if the insured person is diagnosed with a critical illness covered by the policy. There is no limitation on the use of the benefits. The insured person can use them for medical or daily expenses. Unlike medical insurance, which covers medical expenses on a reimbursement basis, critical illness is an accelerated death benefit, which enables the policyholder to receive a cash advance against the death benefit. The policy terms contain a specific description of the medical conditions of critical illness. Commonly covered critical illnesses include cancer, disablement, heart and major organ-related diseases. Some products extend the coverage to early-stage illness, such as carcinoma in situ, but the compensation amount is usually a prescribed percentage of the insured sum. For traditional products, they offer only one-time compensation, i.e, the policy will be terminated once the insured person has received the claim payment. Nevertheless, there are also other products emerging in the market accommodating multiple claims by the insured person. If the insured person is diagnosed with one of the prescribed illness and receives a claim payment, the policy is still valid. Even if the insured person is affected by the same illness or diagnosed with another prescribed illness after a specified period, they can still file another claim with the insurer. Be sure to compare the coverage of different products and understand the definitions before taking out a policy. Also, the design of the products with multiple benefits is relatively complex. The terms and conditions vary among products, including the definitions of new diseases, recurrence and waiting periods. To avoid a claim dispute in the future, you should read the relevant terms and conditions carefully, and consult your insurer or intermediary if needed. You should also assess if the benefit is sufficient to cover daily expenses if you lose your ability to work due to serious illness, especially the benefit for the first time being diagnosed with a critical illness, as it is uncertain whether a person recovered from critical illness will contract the illness again. The policy terms contain a specific description of the medical conditions of critical illness. Commonly covered critical illnesses include cancer, disablement, heart and major organ-related diseases. Some products extend the coverage to early-stage illness, such as carcinoma in situ, but the compensation amount is usually a prescribed percentage of the insured sum. For traditional products, they offer only one-time compensation, i.e, the policy will be terminated once the insured person has received the claim payment. Nevertheless, there are also other products emerging in the market accommodating multiple claims by the insured person. If the insured person is diagnosed with one of the prescribed illness and receives a claim payment, the policy is still valid. Even if the insured person is affected by the same illness or diagnosed with another prescribed illness after a specified period, they can still file another claim with the insurer. Be sure to compare the coverage of different products and understand the definitions before taking out a policy. Also, the design of the products with multiple benefits is relatively complex. The terms and conditions vary among products, including the definitions of new diseases, recurrence and waiting periods. To avoid a claim dispute in the future, you should read the relevant terms and conditions carefully, and consult your insurer or intermediary if needed. You should also assess if the benefit is sufficient to cover daily expenses if you lose your ability to work due to serious illness, especially the benefit for the first time being diagnosed with a critical illness, as it is uncertain whether a person recovered from critical illness will contract the illness again. Be sure to compare the coverage of different products and understand the definitions before taking out a policy. Also, the design of the products with multiple benefits is relatively complex. The terms and conditions vary among products, including the definitions of new diseases, recurrence and waiting periods. To avoid a claim dispute in the future, you should read the relevant terms and conditions carefully, and consult your insurer or intermediary if needed. You should also assess if the benefit is sufficient to cover daily expenses if you lose your ability to work due to serious illness, especially the benefit for the first time being diagnosed with a critical illness, as it is uncertain whether a person recovered from critical illness will contract the illness again. For traditional products, they offer only one-time compensation, i.e, the policy will be terminated once the insured person has received the claim payment. Nevertheless, there are also other products emerging in the market accommodating multiple claims by the insured person. If the insured person is diagnosed with one of the prescribed illness and receives a claim payment, the policy is still valid. Even if the insured person is affected by the same illness or diagnosed with another prescribed illness after a specified period, they can still file another claim with the insurer. Be sure to compare the coverage of different products and understand the definitions before taking out a policy. Also, the design of the products with multiple benefits is relatively complex. The terms and conditions vary among products, including the definitions of new diseases, recurrence and waiting periods. To avoid a claim dispute in the future, you should read the relevant terms and conditions carefully, and consult your insurer or intermediary if needed. You should also assess if the benefit is sufficient to cover daily expenses if you lose your ability to work due to serious illness, especially the benefit for the first time being diagnosed with a critical illness, as it is uncertain whether a person recovered from critical illness will contract the illness again.

The life expectancy of Hong Kong people ranks at the top among developed economies and in the world. In 2020, the life expectancy at birth was 83 years for men and 88 years for women in Hong Kong, an increase of approximately 8 years from 30 years ago.

A longer life expectancy implies more expenses and therefore savings needed. Also, essential expenses, such as health care expenses, may suddenly increase since your health condition may be difficult to predict after you reach retirement age. To save money for a rainy day, you may need to save more now to meet the extra needs brought about by longevity. If you wish to have a stable income after retirement, you can also consider insurance products for retirement planning, such as annuities. Based on your expected retirement expenses, you may have relatively abundant savings at retirement. However, if you wish to have a stable income after retirement, you can also consider insurance products for retirement planning, such as annuities.

An annuity is a retirement planning tool that helps individuals convert their savings into a stable stream of income over a period of time, thus mitigating the financial risks associated with longevity.

Policyholders pay a premium (in a lump sum or by instalments) to an insurer, which in turn, provides them with a regular annuity starting from a designated annuitisation age or period until the policyholder passes away or the end of the annuitisation period.

Do you buy travel insurance for each trip? You may encounter unexpected risks and losses during your travels. Travel insurance provides monetary compensation, and coverage for medical expenses and emergency assistance if you are involved in an accident that involves injury or death. As you are not a frequent traveller, you may consider single trip travel insurance that suits your needs for each trip. Take note of the information below and consider your specific needs for each trip. Do you buy travel insurance for each trip? You may encounter unexpected risks and losses during your travels. Travel insurance provides monetary compensation, and coverage for medical expenses and emergency assistance if you are involved in an accident that involves injury or death. There are generally two kinds of travel insurance products: (1) a policy for each trip; or (2) an annual package to cover an unlimited number of trips during the year (the insurance period). As you are a frequent traveller, you may find taking out an annual travel insurance plan is more economical and comprehensive than a policy for each trip. Take note of the following information, and consider your specific needs for each trip.

| Points to note | Your protection needs |

|---|---|

| Have you booked an air ticket or confirmed your itinerary? | Buy travel insurance as soon as your itinerary is confirmed. If you have to cancel your trip before it starts, you can claim a cancellation benefit, such as non-refundable air ticket and accommodation expenses, depending on the relevant clauses. You will miss out on these benefits if you buy the insurance after the incidents happen. |

| Will you take part in events that have to be paid in advance? | You may require a product that covers these events. Check whether the policy covers losses of irrecoverable charges paid in advance because of trip cancellation and travel delay. |

| Will you take part in amateur sports (e.g. trekking, a marathon, skiing, or scuba diving)? | Some travel insurance products may exclude these events from coverage. Check whether the policy covers accidental death, medical expenses, and personal liability associated with the related sports and activities. |

| Will you rent a car at your destination? | The insurance provided by the rental company at the destination may not suit your personal needs. Before departure, check whether a rental vehicle extension is provided in your travel insurance policy. |

| Will you bring along valuables or electronic items? | Some travel insurance products may set restrictions on the coverage of these items. Check whether the baggage and personal effects protection covers the related items. |

| Building structure | Home contents / personal belongings | Personal liability | Domestic helper protection | |

|---|---|---|---|---|

| Your protection needs | ||||

| Your existing protection | ||||

| What else do you need? |

Building structure: This covers the cost of replacing the building structure. When reviewing your existing coverage or choosing a new product, consider whether the insured amount is adequate and reasonable, and make sure you understand whether your insurance cover is on an “all risks” basis or “specified perils” basis, which affects the risks covered (e.g. fire).

Home contents / personal belongings: Check whether the policy covers household and personal belongings, and whether there is any geographical restriction. In recent years, a number of products have emerged in the market providing cover beyond the household location. Some even provide worldwide coverage for your belongings.

Personal liability: This protection is not limited to owners and tenants, since any individual may face legal liability for accidental death or bodily injury of a third party or accidental loss or damage to a third-party property resulting from negligence. For example, damage to a neighbour’s property from water seepage from your home, or damage to a third party’s property if something falls from your home may result in a personal liability claim. When reviewing your existing coverage or choosing home insurance, consider prudently the insured amount and coverage for this protection. Personal liability: This protection is not limited to owners and tenants, since any individual may face legal liability for accidental death or bodily injury of a third party or accidental loss or damage to a third-party property resulting from negligence. For example, damage to a neighbour’s property from water seepage from your home, damage to a third party’s property if something falls from your home, or injury to a third party if your pet injures them may result in a personal liability claim. In addition to medical coverage for your pet, some pet insurance in the market covers indemnity against third party claims. When reviewing your existing coverage or choosing home or pet insurance, consider prudently the insured amount and coverage for this protection.

Domestic helper insurance: You are obliged to take out employee compensation insurance (“EC insurance”) for your domestic helpers according to the Employees' Compensation Ordinance. In addition, you must provide free medical treatment for your foreign domestic helper (FDH) if he/she is ill or injured during the period of employment, regardless of whether the illness or injury is caused by the employment. When choosing FDH insurance, apart from the basic EC insurance coverage, you should consider the need for additional coverage, such as accident and health protection for your FDH, and employer protection against fraud, dishonesty and personal liability caused by your FDH.

Act Only insurance covers only legal liability for bodily injury or death of a third party arising from the use of the vehicle. No loss or damage to a third party’s property or to your vehicle is insured. Evaluate your personal needs and consider Third Party Liability Only Insurance or a Comprehensive plan for more comprehensive protection, if appropriate.

If you are looking for more comprehensive protection, such as coverage for injury to you or income loss arising from a traffic accident, consider other types of insurance, such as accident and medical insurance.

Third Party Only insurance covers only claims for third party death or bodily injury, or loss or damage to the property of a third party arising from the use of the vehicle. It does not protect against loss or damage to your vehicle. Evaluate your personal needs and consider a Comprehensive plan for a higher level of protection, if appropriate.

If you are looking for more comprehensive protection, such as coverage for accidental injury to you or income loss arising from a traffic accident, consider other types of insurance, such as accident and medical insurance.

Comprehensive plan covers any loss or damage caused to third party's property and to your vehicle, as well as bodily injuries or death of a third party, arising from the use of the vehicle. Review your existing coverage to make sure that you have appropriate protection. For example, is the benefit limit of damage to your car too much or too little?

If you are looking for more comprehensive protection, such as coverage for accidental bodily injuries to you or income loss during the period of hospitalisation, consider other types of insurance, such as accident and medical Insurance.

If you are planning to purchase and drive a motor vehicle, bear in mind that you will be responsible for ensuring the presence of a valid third party risks insurance policy for the vehicle concerned when using it on road, no matter whether you are a car owner or driver. Learn more about various aspects of motor insurance, such as renewal arrangements, excess and No Claim Discount / No Claim Bonus (NCD / NCB), so that you can choose one that suits your future needs.

The curve above reflects your projected changes of mortality protection gap in the future. The level and shape of the protection gap curve are affected by the data you provided according to your current situation and life planning:

- Your personal particulars: the starting point of the protection gap curve (i.e. your current protection gap) depends on your current personal and family situation. Generally, the younger you are, the farther away you are from retirement, which implies that you need to shoulder more future family expenses. As you gain more work experience, an increase in your income may result in an improvement in your family’s standard of living, and a corresponding increase in expenses, leading to higher protection needs.

-

Life planning: The following life-changing events will entail additional expenses and debt for you, thereby enlarging your protection gap. As such, their timing directly affects the shape and peak of the protection gap curve:

- Home purchase: If you take out a mortgage, any outstanding amount will have to be paid off by your family should you pass away.

- Marriage: After marriage, if your spouse stops working to take care of your family, you may need to shoulder more expenses. For example, when your spouse is no longer entitled to employer-provided insurance, you may have to pay for additional medical expenses.

- Childbirth: Raising a child can be expensive, because of tuition fees, transportation costs, and other education expenses. And the bigger the family, the greater the general household expenses and the greater medical expenses of your children.

- Other family needs: The number and status of your family members (e.g. retired parents) will affect the amount of general household expenses and medical expenses. Also, your family expenses will be higher if you have to accept financial responsibility for your parents-in-law, especially after your spouse stops working.

- Wealth accumulation: After deducting your annual expenses and paying off your loans, the remaining of your income will become assets such as bank deposits, stocks and pensions. The amount of your assets may increase depending on your investment performance, and turn out to be important financial resources to cater for your family’s needs.

- Reduction in burden: Future expenses that you need to prepare for your dependents will decrease with their age. Meanwhile, your outstanding mortgage will also be gradually repaid.

- Shape of the curve: The protection gap curve is different for every person. If you have a sizable amount of asset and life insurance coverage, you may not face the problem of mortality protection gap for the future 50 years. Conversely, if there are insufficient financial resources, your protection gap will be a positive number in at least some period of time. If you have prepared for the aforementioned life events, the curve will probably peak at the moment when you have multiple burden. For example, you may be shouldering residential mortgage and have children, and your spouse may have left the workforce for the family. Meanwhile, if you do not have these life plans, your protection gap curve may exhibit less changes. As a smart policyholder, you should review and adjust your insurance portfolio regularly in order to achieve comprehensive and sufficient risk protection.

The Mortality Protection Gap (MPG) refers to a situation in which the dependent family members can no longer maintain the living standard they were used to because of insufficient financial resources after the breadwinner’s death. “Maintaining your living standard” is an important concept in understanding your MPG. Under this concept, after the death of the breadwinner, the remaining family members will not be worse off, as their living standard can be maintained. In other words, the dependents will still receive the same level of medical care and education support, and the family will be able to stay in the same home, whether owned or rented.

Calculating the Mortality Protection Gap now

Individuals’ MPG is obtained by deducting the financial resources available from their current life insurance needs.

(1) Life insurance needs:

The present value of the following expenses is estimated as follows:

i. General household expenses

The typical family expenses are estimated based on the user’s income and household size. Theoretically, household expenditure refers to the actual expenses incurred by households. To be aligned with the Mortality Protection Gap Study 2021, medical and education costs are extracted under certain conditions (for details, please see below) from the calculation of future household expenses as separate items, to allow more detailed discussion of these two expenses.

ii. Future medical needs of dependents

This component takes into account the future medical expenses of three types of dependents: children, spouse and other dependents, such as parents. For the latter two types of dependents, it is assumed that medical expenses will be incurred until their death.

iii. Future education expenses of dependent children

This component considers the accumulated education expenses of the dependent children before they start tertiary education. For children who are currently going to college or university, the relevant education cost is already reflected in the general household expenditure.

iv. Household debt

This includes outstanding residential mortgages, credit card advances and personal loans.

(2) Financial resources

i. Savings and investments

Savings and investments considered in this tool include savings deposits, stocks, mutual funds and other locally listed products, such as Real Estate Investment Trusts (“REITS”) and bonds. Property and physical cash are not considered due to data limitation.

ii. Pension assets

This consists of five types of asset related to retirement schemes: Mandatory Provident Fund (“MPF”), Occupational Retirement Schemes Ordinance (“ORSO”) schemes, Civil Service pension schemes, Grant Schools Provident Fund (“GSPF”) and Subsidized Schools Provident Fund (“SSPF”).

iii. Your current death benefit

(3) Estimation method and assumptions

i. General household expenses

- The estimation of general household expenses is based on the income approach, which assumes that future household expenses will be paid from employment income. Therefore, the users are required to report only current monthly income; they do not have to forecast various future expenses.

-

In this tool, the proportion of expenditure to income for the remaining household members by household size is applied to the reported monthly income and assumed income growth to obtain estimated expenses for each year, and discounted back to the current position as the present value of general expenses. Several adjustments are made, using parameters from the Mortality Protection Gap Study 2021, to convert the income earned by the breadwinner to future household expenditure for the remaining household members if the breadwinner passes away:

- First, assuming the household is not spending all of its income for household expenses, part of the household income is used for savings, contribution to retirement schemes, and paying personal taxes and funding investment. Therefore, the ratio of average household expenditure (from the 2015 Household Expenditure Survey (HES), published by the Census and Statistics Department (C&SD)), to average household income of economically active households (excluding foreign domestic helpers) is calculated to account for this effect.

- Second, some of the household expenses have to be removed from the calculation to avoid double counting. Since the aforementioned medical and education expenses are determined separately in this tool, these expenses should be excluded from the household expenditure of remaining household members. Also, the HES imputed rental expenses for owner-occupier households. This assessment assumes that any outstanding residential mortgage loans will be repaid immediately after the breadwinner’s death, so the imputed rental expenses that were entered would not constitute an actual financial outlay. Therefore, imputed rental expenses for owner-occupier households are excluded.

- Third, after the user passes away, the corresponding family expenses should be lower.

ii. Medical expenses

- Following the Mortality Protection Gap Study 2021, average out-of-pocket medical expenses per person are estimated with reference to data from the Hong Kong Domestic Health Accounts and Hong Kong’s population statistics. Medical inflation is estimated with regard to historical trends regarding public, private and total health expenditure.

- The future stream of dependents’ medical expenses is discounted back to the current situation. For dependents other than children, such as spouse and parents, medical costs are expected to be incurred until their death. The corresponding future expenses are weighted by survival probability at each age, using the Hong Kong Life table published by the C&SD.

iii. Education expenses

- Education-related expenses for dependent children before tertiary education are estimated by category, with reference to data from the Education Bureau and the HKU Public Opinion Programme (POP) Education Expense Survey, and are adjusted by the respective consumer price index (CPI).

- The future stream of children’s education expenses is discounted back to the current situation.

Calculating the Mortality Protection Gap in the future

While the methodology for estimating the MPG at different life stages is essentially the same (i.e. discounting all future obligations back to the concerned time point), additional questions and assumptions are required to account for the following:

(1) Major life events

Users need to answer additional questions about life planning, including life-changing decisions that may trigger an increase or decrease in life insurance needs:

i. Personal decisions

Such as buying a flat, getting married and giving birth.

ii. Dependents’ circumstances

Including when the user’s spouse stops working and the parents’ expected retirement age.

iii. Additional future dependents

Such as parents-in-law who may become the user’s dependents if the user’s spouse stops working.

(2) Wealth accumulation

Assumptions are made to accommodate for changes in household debt and personal savings over time, with reference to government policies and asset market prospects:

i. Salary tax

The calculation involves basic, married person, child and parent/grandparent allowances, assuming the tax band, threshold and structure will not change over time.

ii. Expenditure

An average expense to income ratio is applied. Again, the C&SD’s HES data is used to estimate the ratio.

iii. Mandatory Provident Fund (MPF) contribution

This is 5% of monthly income, capped at $1,500, assuming that the contribution ceiling and structure will not change over time.

iv. Home purchase

- Users are required to provide the expected home price, the amount of the mortgage loan, the mortgage rate and the tenure.

- It is assumed that deposits will be used to finance the down payment first, followed by investment.

- Stamp duty: It is assumed that the user is a first-time buyer and does not own any other residential property in Hong Kong, so Scale 2 of the Ad Valorem Stamp Duty will apply.

v. Investment return

- The assumed return refers to the net holding period return of the Hang Seng Index.

- It assumes no transaction cost if stocks and funds etc. are sold to make up for dissaving (tax, mortgage etc.).

vi. Pension

The growth rate for both opening balance and pension contributions is assumed with reference to historical average MPF return.

vii. Credit card advances and other personal loans

It is assumed that users will repay these loans as soon as resources are available.

viii. Sufficiency of retirement savings

In addition to calculating your MPG over your lifetime, this tool also intends to provide a rough estimate on whether a user has sufficient savings for retirement, to feature the longevity risk faced by the user. This estimation requires additional input from the user of expected monthly expenses at retirement (i.e. future value). As it is rather difficult to estimate expenses needed many years into the future, this option of retirement calculation will be open only to users aged 45 or above.

ix. Expected income growth

The user may have a better idea of income growth in the near term. The income growth rate afterwards is assumed with reference to historical data and the adoption of a more prudent approach.

(3) Life insurance coverage

Users are reminded to check the changing death benefits of certain life insurance products (term life, whole life with dividend accumulation, etc.) and are advised to review their insurance policy for a more accurate lifetime assessment.

This tool is constructed following the income approach used in the Mortality Protection Gap Study 2021. It uses various macro data on household income and expenditure that are available in Hong Kong to estimate average ratios, so as to anchor household expenditure to household income. The major advantage of using the income approach is that users only need to provide their current monthly income, and the tool will generate their current and future Mortality Protection Gap (MPG) using various assumptions. Therefore, users’ time and effort are saved for forecasting other data such as their family expenses for the coming decades.

As the design of this tool is based on certain assumptions, the output value is also subject to the following limitations, which may lead to overestimation or underestimation:

Target audience

This tool’s target audience is working individuals. For those who plan to retire early, it still assumes that they will work until the age of 65, and a share of income is taken as general household expenses, so future expenses may be overestimated.

Personalised spending pattern

This tool uses household characteristics, such as the family members’ age and working status, whether they live together, and home-ownership to estimate the needs at different time points of the typical individual in the society. As the estimation adopts average income and expenditure data for its assumptions, the assessment results will be more accurate for individuals whose situation is closer to the average situation.

Share of responsibility in a household

This tool assumes that each working individual contributes a percentage of their income towards household expenses. In reality, if there is more than one working individual in a household, the actual share of financial responsibility is likely to be different from that assumed in this tool. For example, for a two-person family with both members working, if the user’s spouse has a high income and pays all the household expenses, the user’s MPG may be notably overestimated and vice versa. For households with more than one working person, the breadwinner who pays most of the expenses should take the MPG assessment, as this should better reflect the actual protection needs of the family.

Financial burden from other households

The estimation of general household expenses is confined to the household in which the user is living. Dependents not living together (e.g. parents) are assumed to depend on the user only for medical costs. The protection needs may be underestimated in this note.

Exclusion of other sources of household income

This tool assumed that the household income comprises entirely employment income. It does not include other household income, such as rental income, or dividends and interest from investments.

Future household expenditure for the specific household mix

To discount future expenditure, the expenditure-to-income ratio is calculated based on the current household size. Any changes to the household mix will affect actual protection needs in the future. For example, for single working individuals living with their parents and bearing the financial responsibility of the household until retirement, if one of the parents passes away before they retire, their general household expenses may be overestimated.

Exclusion of certain investments

Savings and investments considered in this tool include savings deposits, stocks, mutual funds and other locally listed products, such as Real Estate Investment Trusts (“REITS”) and bonds. Property and physical cash are not considered due to data limitation.

Assumptions on income growth, investment return and interest rate

Based on the Mortality Protection Gap Study 2021, this tool makes assumptions about income growth, investment return, and the interest rate as follows:

Annual income growth rate: 3.1%

Annual investment return: 6.1%

Interest rate: 1.9%

As these assumptions can significantly affect the size of the estimated MPG, if users have different expectations, they can change these assumptions in the full version.