What types of life insurance products are available?

Should I increase my insurance when I get married?

Should I buy a pure protective product or one with a savings element?

Life insurance is designed primarily to transfer the financial risk incurred by the death of insured persons. It minimizes the impact of their death on their dependents, especially if the insured persons are the primary breadwinners in the family, by providing their dependents with a death benefit to cover their financial needs. Life insurance products have evolved in the past few decades, adding elements like savings, investment, and wealth inheritance options, and even providing employee benefits (i.e. group life insurance) instead of providing only death benefits (i.e. purely protective products).

Common classifications

Coverage period

Fixed term or until a specified age

Operation

- This is a purely protective product. If the insured person passes away during the coverage period, the beneficiary will receive a lump sum death benefit.

- It does not comprise any savings or investment elements, so there is no accumulated cash value upon policy termination.

- In general, for the same premium, the payout for a term life insurance policy is higher than that of other types of life insurance.

Death benefits

This is equal to the insured sum, which is normally a fixed amount, but some policies may offer an amount which varies over the policy terms.

Premium payment

- The premium remains the same over the term, but may increase with age upon renewal.

- Generally, it can be paid annually, monthly, quarterly or half-yearly.

Who should consider it?

Young people with limited financial means and individuals who have high protection needs (e.g. mortgage loan repayment) for a certain period of time or who are looking solely for protection and have other financial plans.

Reminders

- Term life insurance is designed to strengthen the protection of the insured person for a specific period. Consider your protection needs for a specific period, such as how long it will take to pay off your mortgage, and when you expect your children to start working.

- Some policies allow policyholders to convert their existing term insurance to a whole life policy. For such conversions, policyholders are only required to pay the corresponding premium for the new policy, without the need to submit another health record.

- The coverage period varies for different products, but in general, it is guaranteed to be renewable until a specified age.

Coverage period

Lifetime

Operation

- It offers mortality protection for the lifetime of the insured person. If the insured person passes away, the beneficiary will receive a lump sum death benefit.

- It has savings elements and provides a cash value upon policy surrender.

- Some products are participating policies, which allow policyholders to receive non-guaranteed dividends or bonuses from the insurers.

Death benefits

The total amount as shown in the benefits illustration. It normally comprises bonuses or dividends of the policy (if any), at the time of death.

Premium payment

- It can generally be paid in a single premium or by instalments (i.e. annually, monthly, quarterly or half-yearly).

- The premium normally remains unchanged over the term of the policy.

Who should consider it?

Individuals in a strong financial situation who want both protection and long-term savings.

Reminders

- It has a lifetime policy term. It takes a long time to accumulate the cash value, which means it requires a long-term financial commitment from the policyholder.

- Early surrender of the policy will result in a significant financial loss, with policyholders getting far less than they paid.

- For participating policies, the cash value comprises non-guaranteed dividends or bonuses, which will be affected by the insurers’ investment strategy and performance, claim experience, operational expenses, etc. The final payout may be higher or lower than the projected payout illustrated in the benefits illustration.

Coverage period

Fixed term

Operation

- If the policy term ends or the insured person passes away, the insurer will pay a lump sum to the policyholder or the beneficiary.

- It has a savings element and provides a cash value upon policy surrender.

- Some products are participating policies, which allow policyholders to receive non-guaranteed dividends or bonuses from the insurer. The savings element in endowment insurance is greater than that in whole life insurance.

Death benefits

The total amount as shown in the benefits illustration. It normally comprises bonuses or dividends of the policy (if any), at the time of death.

Premium payment

- It can generally be paid in a single premium or by instalments (i.e. annually, monthly, quarterly or half-yearly).

- The premium normally remains unchanged over the term of the policy.

Who should consider it?

Individuals with specific savings goals.

Reminders

- The savings function is the main feature, so the life protection part is relatively weak.

- Early surrender of the policy will result in a significant financial loss, with policyholders getting far less than they paid.

- For participating policies, the cash value comprises non-guaranteed dividends or bonuses, which will be affected by the insurers’ investment strategy and performance, claim experience, operational expenses, etc. The final payout may be higher or lower than the projected payout illustrated in the benefits illustration.

Coverage period

Fixed term or lifetime

Operation

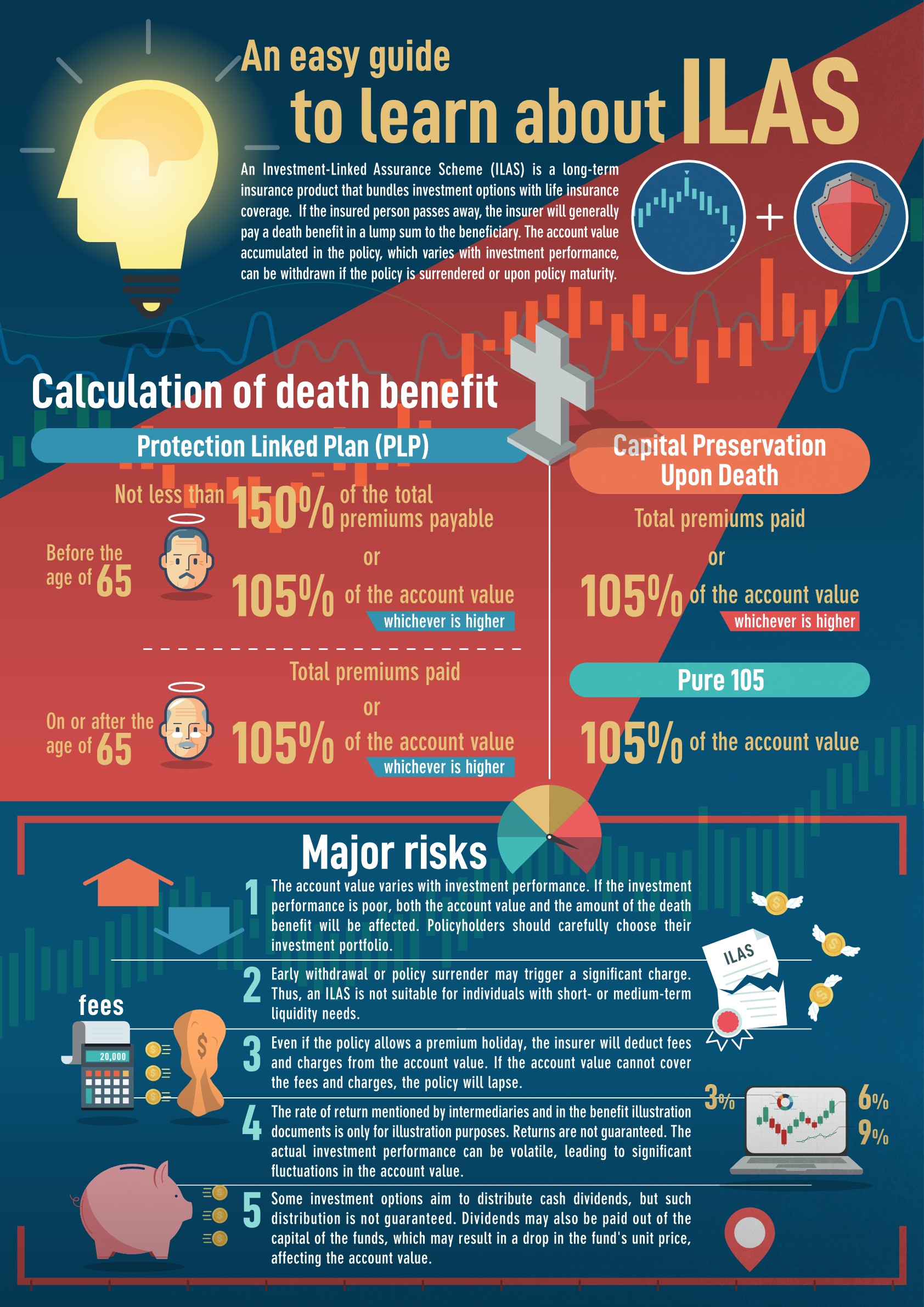

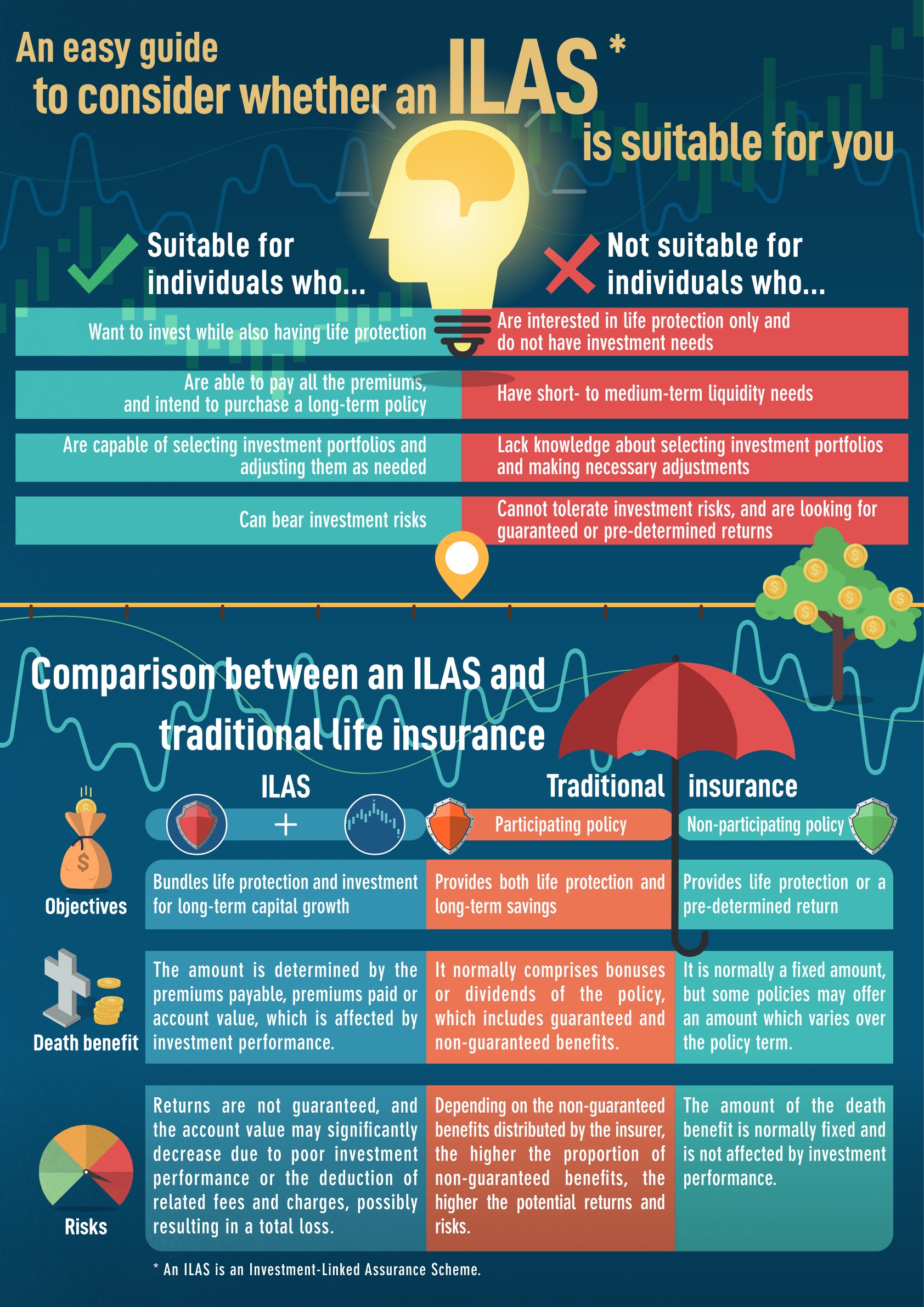

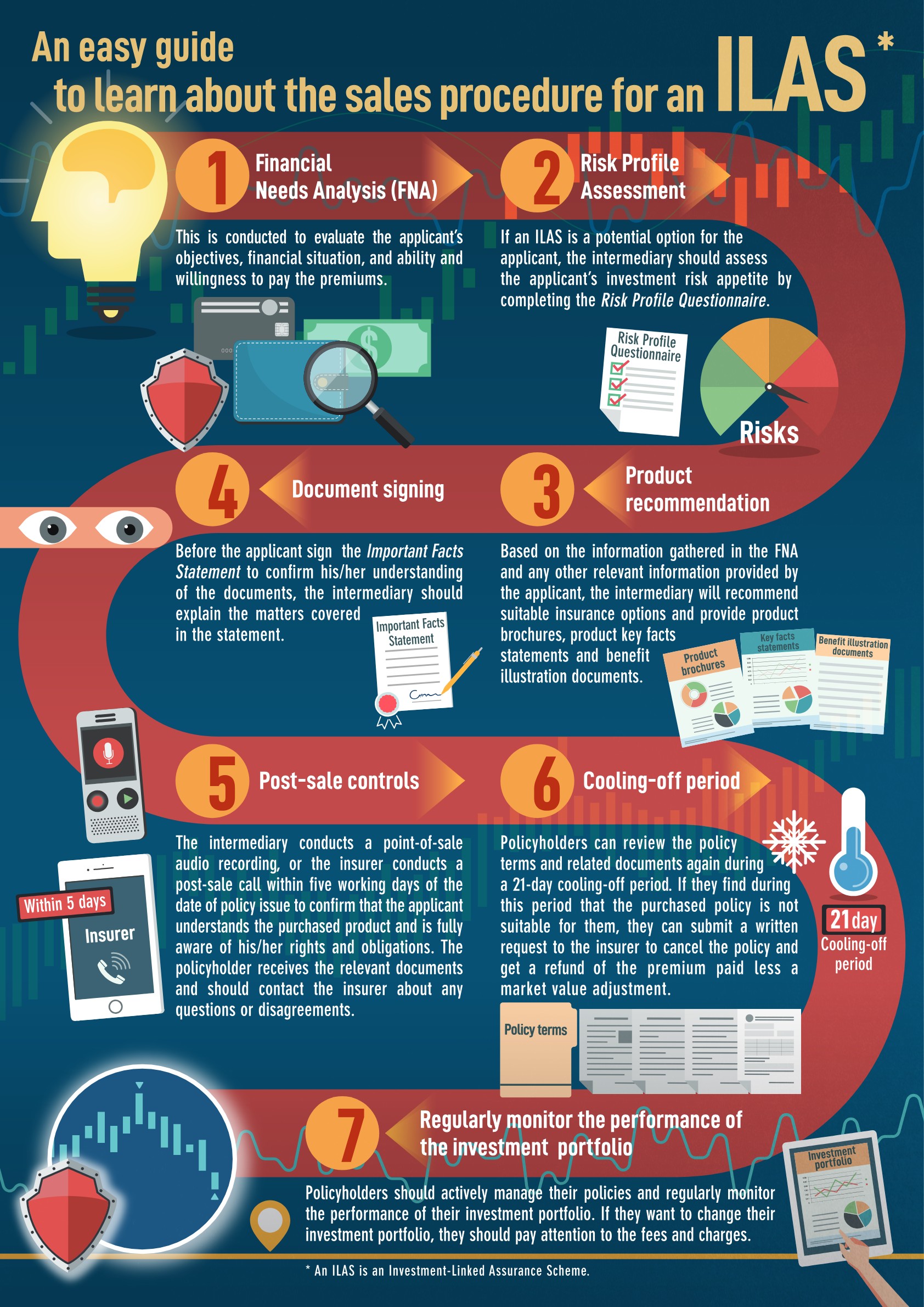

- It bundles life insurance and investment options. If the insured person passes away, the insurer will pay a lump sum to the beneficiary; in the meantime, the policy accumulates account value.

- The account value of the policy varies with the investment performance of the funds or assets selected by the policyholder.

- If the investment performance is poor, the account value of the policy may decrease or even be lower than the total premiums paid.

Death benefits

The amount of the death benefit is based on the amount of total premiums payable, total premiums paid and the account value, which will vary with investment performance; there is a minimum protection level, as stipulated in the guideline and related interpretation notes# issued by the Insurance Authority.

Premium payment

- It can generally be paid in a single premium or by instalments (i.e. annually, monthly, quarterly or half-yearly).

- The premium normally remains unchanged over the term of the policy.

- Some policies allow policyholders to apply for premium holidays. However, the fees and charges are still applicable during the premium holiday and are deducted from the account value.

Who should consider it?

Individuals who are going to hold the policy for a long period and are capable of choosing and managing their investment portfolio.

Reminders

- Life protection is affected by the performance of the investment portfolios. If the investment performance is poor, the account value of the policy may decrease, leading to a significant drop in the amount of the death benefit which may be insufficient for protection needs.

- If a certain amount was withdrawn from the policy during the coverage period, the death benefit will be reduced accordingly.

- Early withdrawal or policy surrender before the specified term may trigger a significant charge. Thus, an ILAS is not suitable for individuals with short- or medium-term liquidity needs.

- It involves various fees and charges, such as the cost of insurance, surrender charges, administrative charges, investment change fees and fund management fees.

- It may involve high-risk investment. When choosing an investment option, be sure that you fully understand the fund’s features, risks, fees and charges, and the background of the fund company; and regularly monitor the fund’s investment performance.

An easy guide

Coverage period

Generally lifetime, but flexible depending on the policy terms

Operation

- If the insured person passes away, the insurer will pay a lump sum to the beneficiary.

- It has a savings element, which can accumulate account value.

- There is flexibility in terms of premium payments and withdrawals of account value. Policyholders are normally allowed to adjust the premium amount and withdraw the account value according to the policy terms. They can also use the interest earned to pay premiums.

- The account value increases with non-guaranteed interest paid by insurers and decreases with deductions for the cost of insurance and other charges.

- Insurers pay non-guaranteed interest according to a regularly declared crediting interest rate. Some policies have a minimum guaranteed crediting interest rate.

Death benefits

This is normally the amount shown in the policy or the account value at the time of death, whichever is higher; or a specified percentage that is higher than the account value at the time of death.

Premium payment

- It can generally be paid in a single premium or by instalments (i.e. annually, monthly, quarterly or half-yearly).

- Policyholders may increase the premium amount according to the policy terms during the coverage period.

- Some policies allow policyholders to apply for premium holidays. However, the fees and charges are still applicable during the holiday and are deducted from the account value.

Who should consider it?

Individuals in a strong financial situation who have a basic knowledge of insurance and financial management; or those who may need to partially withdraw the account value in the future to meet liquidity needs.

Reminders

- There are uncertainties related to interest rates, as they are influenced by many factors.

- If a certain amount has been withdrawn from the policy during the coverage period, the death benefit will be reduced accordingly.

- It involves different fees and charges, such as the cost of insurance, administrative charges, and surrender charges.

Different life events, such as marriage and childbirth, will affect your mortality risk and protection needs. Consider your current circumstances and purpose of buying insurance, and then evaluate your protection needs and financial resources before taking out a new life insurance policy or adjusting your coverage and insured amount. In general, the younger you are when you take out a life insurance policy, the lower premium level will be. When you are young, long-term coverage will cost less, as your mortality ratio is relatively lower.

What is a participating policy?

Many life insurance products in the market are participating policies. They provide policyholders with non-guaranteed benefits by distributing dividends or bonuses, which allow policyholders to share the product profits. Non-guaranteed benefits (also known as dividends or bonuses) are not guaranteed to be paid by insurers. They may not be the same as the insurer’s investment returns. The payout is affected by the insurer’s investment strategy and performance, claim experience, operational expenses, etc. The final payout may be higher or lower than the projected payout illustrated in the benefit illustration. The proportion of non-guaranteed benefits varies amongst different participating products. Generally, a product with a higher proportion of guaranteed benefits means a higher level of protection, and vice versa. Choose a product with a proportion of non-guaranteed benefits that suits your objectives, financial condition and risk appetite.

Refer to the Understanding a Participating Policy webpage on the Insurance Authority website to learn more about how to choose a participating policy and points to note when interpreting fulfilment ratio and benefits illustrations. For other life insurance features, refer to the publication titled Understanding Life Insurance.

Refer to the Understanding a Participating Policy webpage on the Insurance Authority website to learn more about how to choose a participating policy and points to note when interpreting fulfilment ratio and benefits illustrations. For other life insurance features, refer to the publication titled Understanding Life Insurance.

How to fill the protection gap

by life insurance

by life insurance

There will be a protection gap if the breadwinner of a family passes away without enough assets to maintain the current living standard of the dependents. In 2019, the aggregate mortality protection gap for the Hong Kong working population was approximately HK$6.9 trillion, and the average protection gap for each worker was HK$1.9 million. The amount of the protection gap is affected by your family and financial situation, and will keep evolving as your income level changes and you go through different life stages.